What you need to know about Utah Short-Term Health Insurance

Struggling to find coverage? Not sure what your healthcare options are in Utah? Look no further than short-term health insurance plans - a temporary solution that offers help when you need it most. In this blog post, we'll dive deep into the world of short-term health insurance and answer all those burning questions like "What is covered?" or "How much will I pay?". Get ready for comprehensive answers with one simple click!

What is short-term (temporary) health insurance?

Short-term health insurance can help those in temporary or changing life situations who need medical coverage, but don’t have access to more permanent plans. These short-term policies provide reliable protection with a range of healthcare services - from doctor visits and hospitalization to emergency care - should you suddenly find yourself needing them.

Short-term health insurance in UT vs. ACA plans

Looking for affordable short-term health insurance in Utah? You're in luck - the state regulates this type of insurance, so you can buy coverage for up to 364 days. Better yet, you have the option to renew for a total duration of up to 36 months. Stay protected without breaking the bank - check out your options for short-term health insurance in Utah today.

Are short-term health insurance plans available for purchase in Utah?

Uncover budget-friendly short-term health insurance options in Utah! Your age, health status, and preferred coverage affect the costs. While monthly premiums are lower than ACA plans, there's a catch. You may sacrifice some coverage benefits. Let's explore what works for your family so, you don't have to worry about being uninsured again..

How much does short-term health insurance cost in Utah?

Short-term health insurance in Utah offers varying coverage options with costs dependent on your age and overall health status. Though it costs less than ACA plans, Keep in mind the tradeoff of lower monthly premiums for potentially less rigorous coverage. It may not provide the same extensive coverage. Choose your plan wisely.

The average monthly premium for a short-term health insurance plan sold in Utah was $162.48 in 2022, according to data from IHC Specialty Benefits.

What if you have a pre-existing condition?

71% original - What if you already have a health condition? Short-term health insurance plans rarely offer coverage for preexisting medical conditions, meaning your claims for treatment may be denied. In Utah, they aren't required to cover pre-existing conditions. Even conditions that weren't diagnosed before you signed up may not be covered. Short-term insurers can deny coverage based on your medical history or charge extra. Also, many chronic conditions are excluded from coverage altogether. Coverage length and renewal options vary by state, and there may be waiting periods before coverage begins. It's important to carefully review your plan and ask about any limitations before purchasing.

Who can buy short-term health insurance in Utah?

Find out if you're eligible for short-term health insurance in Utah. Generally, residents are eligible if they're under 65 and in good health. But be aware that short-term plans often exclude pre-existing conditions, and don't cover essential health benefits like prescription drugs or mental health care. Plus, there may be caps on how much the plan will pay for your care, leading to high out-of-pocket costs. For better coverage, consider an ACA-compliant major medical plan, which covers pre-existing conditions and offers comprehensive coverage. These plans are available during an annual open enrollment window or during certain qualifying life events and offer monthly enrollments with premium subsidies available for those who qualify.

Who is short-term health insurance good for?

If you don’t want to risk financial ruin from unexpected medical bills. Short-term health plans could be a good option. Short-term plans can provide indispensable coverage for a variety of medical expenses like hospital care, emergency room visits, surgeries, and more. And the best part? These plans almost always cost significantly less than traditional health insurance plans making them worth considering.

1. Need to fill a gap between employer coverage and your next job

2. In an employer waiting period

Why risk being uninsured during the waiting period before you become eligible for employer-sponsored health insurance benefits? Short-term health insurance offers coverage that starts within 24 hours after you pay your initial monthly premium.

3. Missed open enrollment

If you missed the Open Enrollment Period and haven’t undergone a qualifying life event that makes you eligible for a special enrollment period, enroll in a short-term medical plan. Though not compliant with Obamacare’s requirements, it can offer some peace of mind.

4. Waiting for coverage to begin under a special enrollment period

If you’re waiting for coverage to begin under a special enrollment period, consider picking up a short-term health plan to stay protected in the meantime.

5. Retiring early and don't yet qualify for Medicare

Consider buying a short-term health insurance plan to avoid paying for major healthcare expenses entirely out-of-pocket between early retirement and Medicare eligibility.

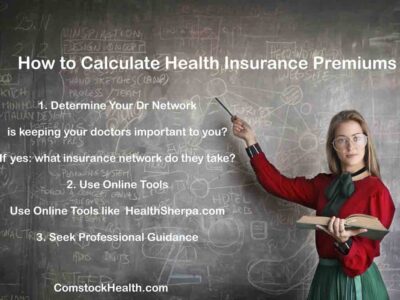

How to Calculate Health Insurance Premiums

How Are Health Insurance Premium Calculated? “How to Calculate Health Insurance Premiums” To calculate health insurance premiums, you typically need to consider factors such as your age, the type of coverage you want, your location, and your health status, all of which can influence the final cost of your premium. Factors Influencing Health Insurance Premiums…

Utah Health Insurance Laws

Utah health insurance laws are fairly standard as we are part of the federal Obamacare Marketplace. That means the rules are standandardized the coverage is also similiar with just a few adjustments for individual states. welcome to our ultimate guide on Utah health insurance laws. In this article, we’re about to dive into the nitty-gritty…

Utah Health Insurance Coverage Explained

Utah Health Insurance Coverage Explained Utah health insurance coverage is straight-up important for keeping you and your loved ones protected from unexpected medical costs. Now, I get it – the whole health insurance thing can feel like a wild ride, especially in a growing state like Utah. But, fear not! This comprehensive guide is here…

Utah Doctors Accepting Medicaid – how to search

Utah doctors accepting Medicaid. Listen up! When it comes to finding the right healthcare provider, it’s downright crucial for everyone. But for folks with Medicaid coverage, it can be a real challenge, especially in Utah. You need access to doctors who accept Medicaid, otherwise, you might not get the medical care you need. But don’t…

Utah pre-existing Condition Coverage: Can I get coverage?

Utah pre-existing condition coverage. Your, health insurance is a crucial part of affording healthcare, especially if you’ve got pre-existing conditions. Now, in Utah and many other states, these conditions have sparked some heated debates, getting people talking about the moral and legal stuff. So, in this blog post, we’re gonna dig deep into the complexities…

Utah Health Insurance Out-of-Pocket Maximum: What You Need to Know

Utah Health Insurance Out-of-Pocket Maximum: What You Need to Know. Check it out! We all know health insurance is key to keeping your healthcare costs in check. It’s like having your back when you need it most, right? But here’s the deal, understanding terms, like “out-of-pocket maximum,” can be a real head-scratcher. No worries though,…

Utah Health Insurance Enrollment: Get Covered

Utah Health insurance enrollment is a major deal when it comes to keeping yourself in tip-top condition. Especially in Utah, where having proper coverage means you’ll have access to all the healthcare services you need, with no stress. This article’s going to break down, all you need to know about Utah health insurance enrollment. We’re…

Health Insurance Companies in Utah

Health Insurance Companies in Utah Okay, when it comes to health insurance companies in Utah, Utah offers health insurance coverage through six insurers, with all counties except Sanpete County having multiple providers. This ensures residents have a variety of options to choose from when selecting their coverage. Having the right coverage is crucial. Whether you’re…

Utah Health Insurance Subsidies

Utah Health Insurance Subsidies Check it out. Utah health insurance subsidies, there’s a major way to get financial help for your health insurance. It’s called the Premium Tax Credit (PTC) and it’s straight-up legit. Here’s the deal: if you’re an individual or family with moderate to low income, you might qualify for these credits when…

Utah Medicare: What you need to know

Utah Medicare What you need to know Utah Medicare: What you need to know Hey there, Utahns! Did you know that those of you currently covered by a Medicare plan can switch or drop a plan during the upcoming Annual Election Period? That’s right – from October 15 to December 7, 2023, you have the…