“Understanding Utah Group Health Insurance”

Health insurance is like a trusty sidekick for employers. In Utah, the group option is all the rage, offering a one-two punch of affordable healthcare and comprehensive coverage for the crew. This blog post is here to spill the tea on the benefits of Utah group health insurance, the various plans on offer, and how business bosses can pick the best health coverage for the team.

Benefits of Utah Group Health Insurance

Group health insurance has your back, gifting employer and employee alike a matchless present of accessible healthcare. Group plans are usually cheaper for peeps than individual ones, and with contributions from bosses, employees are even more well-positioned to smile. Plus, they offer top-tier coverage, all the while sticking to the Affordable Care Act's must-haves, including hospitalization, prescription drugs, and preventative care.

Types of Utah Group Health Insurance Plans

If you're in Utah, there's no shortage of group health insurance plans to choose from. There are several types of group health insurance plans available in Utah. The most common types include:

- Small Group Health Insurance Plans: These plans are designed for businesses with 2-50 employees. They can be more affordable than individual plans.

- Large Group Health Insurance Plans: These plans are designed for businesses with more than 50 employees. They offer similar coverage to small group plans but may have different pricing structures.

- Self-Insured Group Health Insurance Plans: These plans are funded by the employer rather than an insurance company. Self-Insured group plans allow for more flexibility and cost-effectiveness (remember, with risk comes reward).

Choosing the Right Utah Group Health Insurance Plan

When it comes to selecting a plan, the bottom line is often the deciding factor. Take note of the costs of premiums and deductibles for both you and your employees. Stay creative and search for the plan that best suits your team's needs!

Coverage:

Look for a plan that has acceptable deductibles. Deductibles can mean the difference between getting coverage benefits or not being covered at all. Each person is going to have different coverage needs such as prescriptions, blood work, and rehabilitation. Know your family's needs and choose the plans that work best for those. (you can get different health insurance plans for individual family members. There is no discount for having multiple people on the same plan)

Flexibility:

Flexibility:

Consider whether the plan allows employees to choose their own doctors or requires them to use a specific network. I always recommend a PPO network. Some Utah group health insurance plans are on PPO doctor networks which offer flexibility to use any doctor or facility. Ask for a PPO.

Employee needs:

Employee needs:

Take into account the healthcare needs of your employees and their families. Most importantly, you must consider how group plans make employees and their families in eligible for subsidized plans. I've seen this too many times to count. The employee's family would've qualified for free insurance but their employer offered them a group plan. In some cases, HRAs are an excellent option for employers wanting to offer benefits.

Compliance:

Compliance:

Ensure that the plan complies with all state and federal regulations.

Conclusion

Utah group health insurance plans provide essential healthcare coverage to employees of all types of businesses. By offering group health insurance, employers can provide access to affordable healthcare and attract and retain top talent. When choosing a plan, it's important to consider factors such as cost, coverage, and flexibility. By doing so, employers can select a plan that meets the needs of their business and their employees.

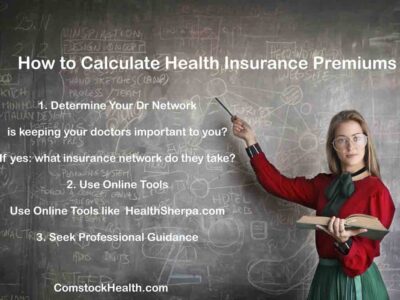

How to Calculate Health Insurance Premiums

How Are Health Insurance Premium Calculated? “How to Calculate Health Insurance Premiums” To calculate health insurance premiums, you typically need to consider factors such as your age, the type of coverage you want, your location, and your health status, all of which can influence the final cost of your premium. Factors Influencing Health Insurance Premiums…

Utah Health Insurance Laws

Utah health insurance laws are fairly standard as we are part of the federal Obamacare Marketplace. That means the rules are standandardized the coverage is also similiar with just a few adjustments for individual states. welcome to our ultimate guide on Utah health insurance laws. In this article, we’re about to dive into the nitty-gritty…

Utah Health Insurance Coverage Explained

Utah Health Insurance Coverage Explained Utah health insurance coverage is straight-up important for keeping you and your loved ones protected from unexpected medical costs. Now, I get it – the whole health insurance thing can feel like a wild ride, especially in a growing state like Utah. But, fear not! This comprehensive guide is here…

Utah Doctors Accepting Medicaid – how to search

Utah doctors accepting Medicaid. Listen up! When it comes to finding the right healthcare provider, it’s downright crucial for everyone. But for folks with Medicaid coverage, it can be a real challenge, especially in Utah. You need access to doctors who accept Medicaid, otherwise, you might not get the medical care you need. But don’t…

Utah pre-existing Condition Coverage: Can I get coverage?

Utah pre-existing condition coverage. Your, health insurance is a crucial part of affording healthcare, especially if you’ve got pre-existing conditions. Now, in Utah and many other states, these conditions have sparked some heated debates, getting people talking about the moral and legal stuff. So, in this blog post, we’re gonna dig deep into the complexities…

Utah Health Insurance Out-of-Pocket Maximum: What You Need to Know

Utah Health Insurance Out-of-Pocket Maximum: What You Need to Know. Check it out! We all know health insurance is key to keeping your healthcare costs in check. It’s like having your back when you need it most, right? But here’s the deal, understanding terms, like “out-of-pocket maximum,” can be a real head-scratcher. No worries though,…

Utah Health Insurance Enrollment: Get Covered

Utah Health insurance enrollment is a major deal when it comes to keeping yourself in tip-top condition. Especially in Utah, where having proper coverage means you’ll have access to all the healthcare services you need, with no stress. This article’s going to break down, all you need to know about Utah health insurance enrollment. We’re…

Health Insurance Companies in Utah

Health Insurance Companies in Utah Okay, when it comes to health insurance companies in Utah, Utah offers health insurance coverage through six insurers, with all counties except Sanpete County having multiple providers. This ensures residents have a variety of options to choose from when selecting their coverage. Having the right coverage is crucial. Whether you’re…

Utah Health Insurance Subsidies

Utah Health Insurance Subsidies Check it out. Utah health insurance subsidies, there’s a major way to get financial help for your health insurance. It’s called the Premium Tax Credit (PTC) and it’s straight-up legit. Here’s the deal: if you’re an individual or family with moderate to low income, you might qualify for these credits when…

Utah Medicare: What you need to know

Utah Medicare What you need to know Utah Medicare: What you need to know Hey there, Utahns! Did you know that those of you currently covered by a Medicare plan can switch or drop a plan during the upcoming Annual Election Period? That’s right – from October 15 to December 7, 2023, you have the…